What is carbon tax?

A carbon tax is a fee paid on the carbon content of goods and services. Typically applied to the energy and transport sectors, carbon taxes are used to encourage the reduction of CO2 and other greenhouse gas emissions. Currently, national carbon taxes are established in 25 countries, including Japan, Ukraine, Canada, and Argentina.

Governments use a carbon tax to penalize companies that burn fossil fuels, which can lower the demand for those products because of the knock-on price increase for consumers.

In order for countries to meet the temperature targets outlined in the Paris Climate Change Agreement, the pressure is growing to bring down emissions and move towards cleaner options, such as solar, wind, and hydropower.

Does carbon tax work?

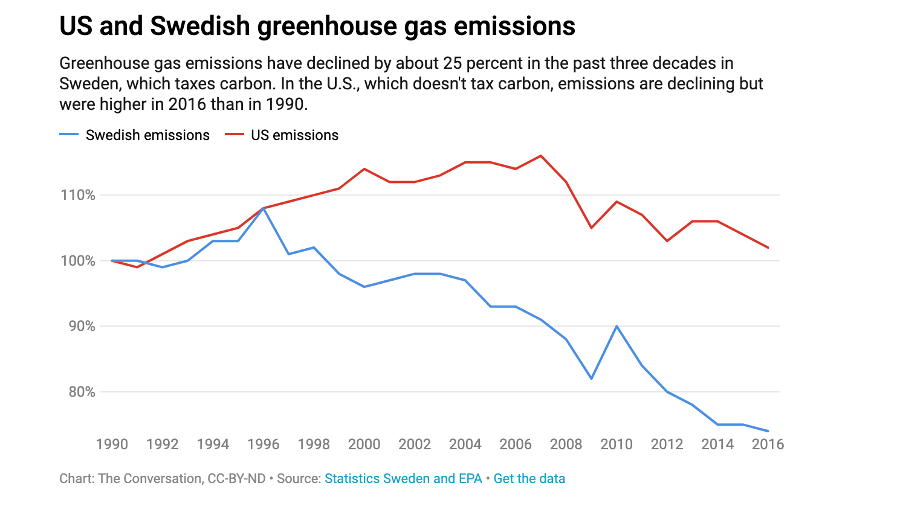

One of the main positives of a carbon tax is that it can reduce emissions by forcing customers and energy providers to seek out cheaper, cleaner alternatives. Since Sweden implemented a carbon tax in 1990, its emissions have fallen by 25%.

Using carbon tax to decrease emissions has shown success in the EU, where the rising cost of allowances and cheaper natural gas have reduced the role of coal in the energy sector, leading to an 8.3% drop in emissions in 2019.

Furthermore, when governments introduce a carbon tax, it can create jobs. According to the 2020 U.S. Energy & Employment Report, there are more than twice as many jobs in solar technology than in coal mining.

Where does the carbon tax money go?

The revenue raised from imposing carbon tax is used in different ways by different countries. Some countries are giving the money back to residents as a dividend – not only to boost the economy but to ensure that populations are onboard with carbon taxing. In Canada, the aim is to return 90% of the revenue from carbon tax back to residents.

Other countries are reinvesting the money into improving transport networks, research into cleaner forms of energy, and subsidising alternative energy options at the consumer level.

Implications for developing countries

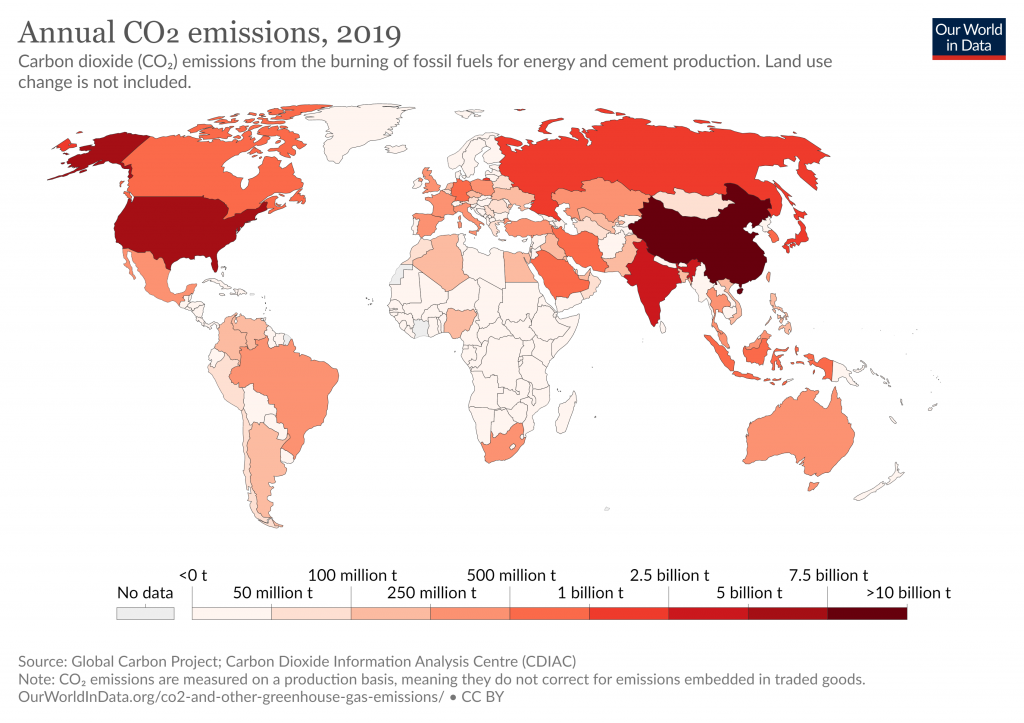

A recent report published in the American Economic Journal found that carbon tax on shipping could reduce emissions, but it could have negative consequences for developing nations. Countries in Southeast Asia, sub-Saharan Africa, and the Indian subcontinent are not only at high risk from rising global temperatures but also rely heavily on fossil fuels for export income.

Developing nations who may not need to impose a carbon tax, because of their comparatively low emission rates, may experience something called ‘carbon leakage’. This means that it will become cheaper to produce energy-intensive goods in those countries, hence these industries could relocate there to avoid heavy taxation. Positively, this would increase exports for developing countries, but it could also mean an upsurge of ‘dirty’ industries in these nations, which would ultimately have negative consequences.

And even countries with the required assets may find it hard to capitalize on these opportunities, because of the same kinds of issues that have constrained growth in general, such as low human capital, poor investment climate, market failures, lack of institutional capabilities, organizational challenges, and lack of access to finance.

Source: Overseas Development Institute

Where to go from here

If we are to meet the goals laid out in the Paris Agreement, shared global responsibility of greenhouse gas emissions is key. For carbon taxing to be effective, it should be combined with complementary measures, such as:

- Subsidized wind, solar, and hydropower

- Ending government subsidies to gas, coal, and oil companies

- Creating and promoting reliable public transport systems

Actions that take into account the environmental well-being of planet Earth as well as the social health of every country, are more likely to be sustainable for all of humankind.

For a truly thrivable future, a widespread collaborative effort must be embarked upon, taking into account the real impact on each and every country.

References

The Conversation. 2019. With the right guiding principles, carbon taxes can work. Available at: https://theconversation.com/with-the-right-guiding-principles-carbon-taxes-can-work

United Nations Climate Change. 2020. Calls increase to use carbon pricing as an effective climate action tool. Available at: https://unfccc.int/news/calls-increase-to-use-carbon-pricing-as-an-effective-climate-action-tool

US Energy Jobs. 2020. 2020 U.S. energy & employment report. Available at: https://static1.squarespace.com/static/5a98cf80ec4eb7c5cd928c61/t/5ee783fe8807d732d560fcdd/1592230915051/2020+USEER+EXEC+0615.pdf

The Guardian. 2018. Canada passed a carbon tax that will give most Canadians more money. Available at: https://www.theguardian.com/environment/climate-consensus-97-per-cent/2018/oct/26/canada-passed-a-carbon-tax-that-will-give-most-canadians-more-money

Shaprio, J. 2016. Trade costs, CO2, and the environment. Available at: https://pubs.aeaweb.org/doi/pdfplus/10.1257/pol.20150168

Ellis, K, et. al. 2010. Growth in a carbon-constrained economy. Available at: https://www.odi.org/sites/odi.org.uk/files/odi-assets/publications-opinion-files/6097.pdf