What is ESG?

ESG is facing a slew of criticism from experts due to its limitations in truly contributing to sustainability. We explain this by the essence of ESG being inward-looking rather than outward-looking. ESG is the consideration of environmental, social and governance factors alongside financial factors in business decision-making. Sustainability, on the other hand, is about reducing negative externalities to the environment and society. In order to accurately unpick the ESG vs sustainability question, it is essential to define both these concepts.

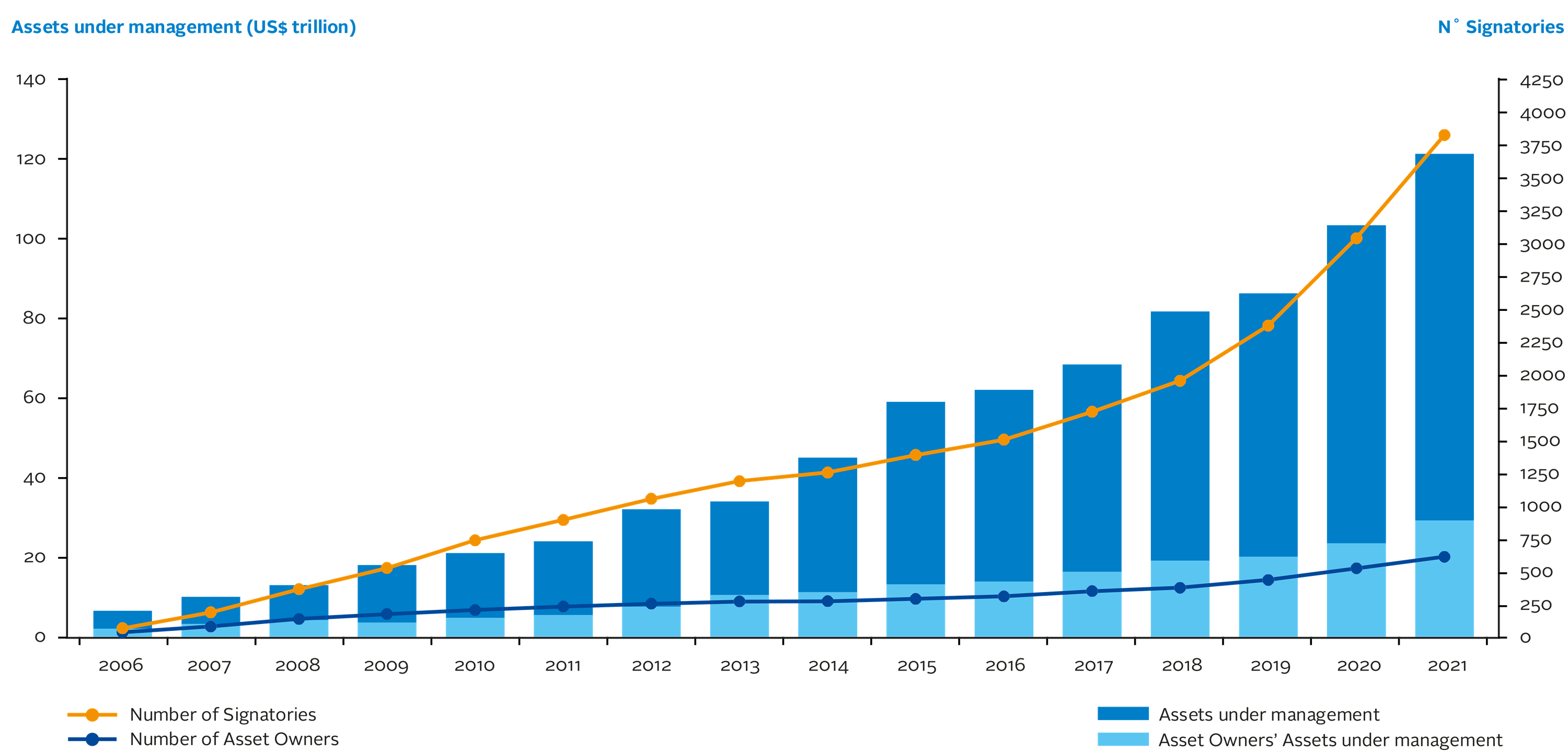

ESG is the consideration of environmental, social and governance factors alongside financial factors in assessing an organisation’s business practices and performance (Deloitte, 2023). It is commonly referred to in the field of finance, with investors or fund managers using ESG criteria in the investment decision-making process (MSCI, 2023). This is known as ESG investing. Initially, 63 investors (managing $6.5 million) signed the Principles for Responsible Investment (PRI) in 2006. This number grew to almost 4,000 (managing $121 trillion) by the end of 2021 (PRI, 2022).

Source: Principles for Responsible Investment

In the ESG vs sustainability debate, almost half (48 per cent) of asset owners said the impact of ESG was preferred to implementing sustainability. This is an increase from 38% last year and 34% in 2020 (Schroders, 2022). ESG has been at the forefront of boardroom discussions over recent years. An increasing number of large corporations are assigning Chief Sustainability officers to the C-suite. To make meaningful progress, corporations are also tying compensation to achieving sustainability targets (Edmans, 2023).

Pressure is on regulators and policymakers to establish robust and standardised definitions and policies. Furthermore, customers are willing to spend more on products which boast good causes (Capterra, 2022).

What is Sustainability?

Sustainability is creating and maintaining conditions under which humans and nature can co-exist in harmony to support present and future generations (Environmental Protection Agency, 2022).

The Carbon Disclosure Project (CDP) emphasises the need for consistent, standardised, and comparable disclosure by companies to help build a sustainable future;

“When it comes to building a more sustainable economy, being on the same page as everyone else is crucial. As companies, cities, states and regions journey towards net zero, we must ensure consistency in benchmarks, science-based targets, and definitions of terms.”

CDP, 2023

Science-based targets which clearly define a way forward form the basis for sustainability. This is in line with the Paris Agreement goal of keeping global temperatures well below 2 degrees – ideally 1.5 degrees – to avoid irreversible climate change. The THRIVE Framework incorporates the importance of science-based targets in ensuring accountability and clarity. It also goes beyond numerical targets to include context-based metrics which tests the scale and significance of the issue.

Environment protection is the most important and urgent issue at hand given the world’s current state. However, sustainability also encapsulates societal well-being and economic advancement. The THRIVE Project takes sustainability one step further to inform us of Thrivability. Humanity is capable of looking beyond mitigating strategies to maintain the status quo. Thrivability encourages innovative and transformative ways to develop the planet to a better place than its current state.

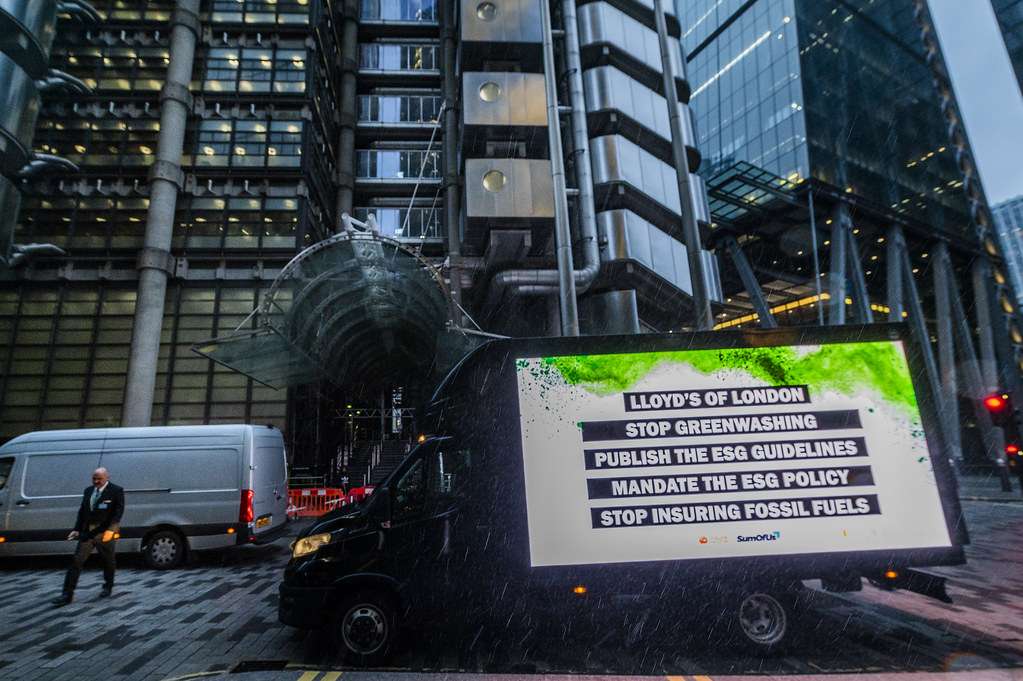

the difference between terminology: ESG vs Sustainability and greenwashing

Although ESG has been one of the fastest-growing investor segments, it is now facing a reckoning. Despite only being in the market for less than 20 years, the term ESG is already considered a faux. Companies across the world have been taking advantage of the label “ESG” to attract investors under false pretences. Critics have been warning investors and individuals of greenwashing. For example, a Bloomberg study found that of 4,800 ESG funds representing $2.3 trillion in total assets, at least $8.3 billion of these were held in Russian assets just before Russia launched a military attack against Ukraine (Private Banker International, 2022).

Investors trust fund managers to make ethical decisions with their funds. However, there are insufficient regulations to promote transparency and accountability.

In May 2022, German police raided the offices of one of the country’s most prominent asset managers, DWS (majority owned by Deutsche Bank) as part of a probe into allegations of greenwashing (Agnew, Klasa & Mundy, 2022). It was the first time that a fund manager has been in an ESG investigation. This signals a wake-up call for the industry, and is welcoming news for ethically driven investors.

Businesses and investors use the term “ESG” to describe their investment mandate. Using this terminology implies that they are serving the purpose of sustainability in their agenda. This was the start of the conflation of the two terms. It is this conflation which is fundamentally taking away from the meaning of “Sustainability”. The recognition of this distinction has fostered an ESG vs sustainability debate.

Source: Openverse

misuse of the term sustainability

The introduction of ESG in a UN report in 2004 closely followed the introduction of the Sustainability Context Principle by the Global Reporting Initiative (GRI) in 2002. This coincidence brought about two competing phenomena. The former focused on an incrementalist environment, social and governance view. The latter is on normative sustainability performance (Baue, 2022).

ESG grew to revolve more around how environmental, social and governance factors affected financial performance. On the other hand, the purpose of sustainability reporting was to identify how companies’ activities affected the environment and society. This created a problem for GRI as they had to pick a side. They had to decide whether to prioritise the finance-centric powerhouses or stick to its pure sustainability roots (sustainability context principle) (Baue, 2022). Unfortunately, GRI chose the former.

From there onward, the term ESG stopped representing real impact and sustainability. None of the standard-setting bodies such as GRI, the International Sustainability Standards Board (ISSB) or the Value Reporting Foundation (VRF) released requirements or definitions that resonate with the meaning of sustainability (Baue, 2022). However, they refer to the term Sustainability in their publications and mislead their audience.

For example, the Corporate Finance Institute defines ESG in the following way:

“ESG is a framework that helps stakeholders understand how an organisation manages risks and opportunities around sustainability issues.”

There are ongoing discussions by experts on both sides. The critics of ESG (science-based community) must do a better job of influencing the regulators to implement robust and standardised definitions and targets. The ESG promoters (financial industry) need to find solutions to divert financial capital towards environmental, social and economic capital for the betterment of society. In other words, internalise the negative externalities.

moving forward

ESG should incorporate the externalities it imposes on society (Edmans, 2023). However, when companies sell products and services, they do not factor in these costs. There is no standardised measurement of those externalities or determination of price to begin with. Most importantly (and disappointingly), there is no required disclosure of any externalities by companies (City A.M., 2022).

All externalities are a market failure, and thus only regulatory or government intervention can adequately correct this failure. Government can provide subsidies, impose taxes, introduce quotas or enact policies such as minimum wage. Regulators can set standards, promote transparency and ensure comparability. And when regulators and governments fail, the shareholder should have the ethical drive to monitor issues in a company that create negative externalities.

Investors should accept that there is a trade-off of short-term gains to pursue long-term societal benefits. This way companies will be more comfortable reporting short-term losses or dips in performance if they are able to explain the long-term benefits (Edmans, 2023). If this was the case, ESG investors could take on a more responsible and accountable stance, and in doing so they would significantly reduce the chasm in the ESG vs sustainability debate.

Source: Unsplash

ESG Vs Sustainability: Why must we determine the difference?

According to Alex Edmans (2023), ESG is coined as extremely important and nothing significant at the same time. It is considered important as it promotes long-term value creation for shareholders. However, it is not considered special, because it creates long-term financial and social value the same way any other intangible asset such as management quality or corporate culture does.

However, there is global recognition that ESG factors are critical to a company’s long-term value to shareholders. The criticism comes into play here as considering long-term factors to business growth is not ESG investing; it’s investing. This focus on ESG as a tool to protect investments rather than achieve sustainability encapsulates the ESG vs sustainability debate.

It has been known for decades that non-financial factors such as customer satisfaction, employee happiness, and innovation have just as important an impact on company performance as financial factors. The ideology behind behavioural finance was introduced over 40 years ago (Kaplan Financial Education, 2021). This is all suggestive of the fact that ESG is nothing new, and although it is imperative when it comes to determining long-term value, it’s nothing special (Edmans, 2023).

achieving the United Nations Sustainable Development Goals (SDGs) and how they link to ESG vs Sustainability

Regulation has never been more critical. As the ESG market continues to grow, it is vital to establish standards, definitions, and disclosure regulations imminently.

Despite the criticism ESG faces, the solution is not to abandon the field. ESG investing could have an immense impact on sustainability if the market had standardised regulations and definitions that bridged ESG vs sustainability divide. Disclosure and transparency is the first step in moving the market towards more accountability. If we stop politicising and glorifying ESG, we can focus on ESG and sustainability working alongside one another towards a shared goal.

Investors, regulators, scientists, academia and the general public must work together to overcome this issue. Multistakeholder partnerships will play a crucial role in achieving the 2030 agenda. Working together will ensure a solution for the betterment of the entire community and achievement of Sustainable Development Goal 17 which describes “Strengthening the means of implementation and revitalising the Global Partnership for Sustainable Development.”

A Thrivable Framework

At THRIVE we believe that the smallest action can create a very large impact. For example, we can increase awareness of a misleading ESG post on social media. Collectively, our actions may apply sufficient pressure on regulators or standard-setting bodies who are currently being swayed by powerful corporate giants in the industry, to make a positive change.

Visit The THRIVE Project website to learn more about how we are educating, researching and advocating for sustainability. THRIVE goes one step further to ensure we create a thrivable future. Sign up for our newsletter to stay up to date and engage in our regular webinars to be part of the thrivable movement!