The world is increasingly focused on becoming sustainable. So, influencing sustainable company habits has also become prominent for governments around the world. Governments are implementing policies that grant companies benefits for producing energy-efficient products and adopting sustainable business models. This is done through various incentives, and the most popular one for sustainability is energy-efficient tax incentives.

In today’s ever-evolving business landscape, the impact of tax incentives on organizations cannot be overstated. These incentives play a crucial role in shaping company habits, driving decisions, and ultimately influencing the path to sustainability. In this investigation, we go into the powerful world of tax incentive impact, explaining its multifaceted effects on businesses attempting to adopt more eco-conscious practices. From encouraging green initiatives to promoting responsible resource management, the significance of tax incentives in shaping company habits is a captivating narrative worth exploring, as well as advancing sustainability objectives.

Source: BVSA.

Tax incentives have always been utilised by governments in both developing and developed worlds. They are used to encourage and influence companies’ sustainable habits and to participate in reaching a specific economic goal. Some examples include job creation or economic development.

Governments and influencing sustainable company habits

Nowadays, governments are shifting their tax incentive policies to help beat climate change, shift individuals and companies toward more renewable energy sources, and become more sustainable through the use of energy efficiency tax incentives, also known as green tax incentives, credits, or savings. These green tax incentives are able to influence companies’ sustainable habits. And, when companies want to create sustainable products, this, in turn, influences sustainable consumer habits.

The shift to encourage companies to transition to energy-efficient sources will promote the adoption of sustainable business models and change the habits of companies still yet to transition their products and operations to be environmentally friendly and sustainable.

Source: Pexels

What are tax incentives?

Individuals pay taxes on the income earned. Similarly, companies pay tax on profit earned. The government has implemented a way in which companies can get tax incentives for any energy-efficient activities. Therefore, tax incentives are tax savings companies get for performing certain activities in the economy. For example, research & development (R&D) activities can be implemented to create greener jobs, move to sustainable energy sources, and promote innovation. This is one strategy for influencing sustainable company habits.

Energy-efficient tax incentives have the following benefits:

- New and improved technological advancements. The tax savings on company profits will allow companies to reinvest in R&D to improve energy efficiency and renewable energy technologies.

- Cost-cutting. The use of energy-efficient sources will assist companies to cut back on electricity, production, and operation costs.

- A decline in CO2 emissions. This is probably the quickest way for governments to reduce industrial greenhouse gas emissions and the overall carbon footprint at the micro to meso levels.

- A decline in air pollution. The air will be a lot cleaner.

- A rise in smart low carbon business buildings.

- Attract investments.

- Promotes innovation.

how do they influence Sustainable Company Habits?

Tax incentives for energy efficiency can change a company’s sustainable habits drastically. Because companies will try to find ways to improve energy consumption and get the tax benefit. For example, LED lights or sensory lights, which turn off when you are not in the building. Other companies may resort to using solar energy and energy-efficient technologies. However, according to Mareli (2018), the addition of other factors and a change in human behaviour will be an even more effective way to change companies’ sustainable habits. This is in line with the THRIVE Framework’s 12 Foundational Focus Factors

(FFF).Ways to Transition to Efficient Renewal Energy Sources

The United Nations (UN) climate action outlines several solutions the world can adopt to transition to more energy-efficient systems, especially when government aims to influence sustainable company habits. For example:

- The global public should have access to renewable energy technologies – this could also be extended to companies. Access to renewable energy sources must not be limited to only large corporations, the technologies should be so affordable, such that small enterprises also have access.

- Global supply of energy-efficient raw materials – use of thermal insulation materials, and phase change materials for commercial buildings. Other materials, such as recycled building materials, contribute to the shift to clean energy (International Energy Agency).

- Removal of inefficient fossil fuel subsidies – instead, promote the use of carbon prices.

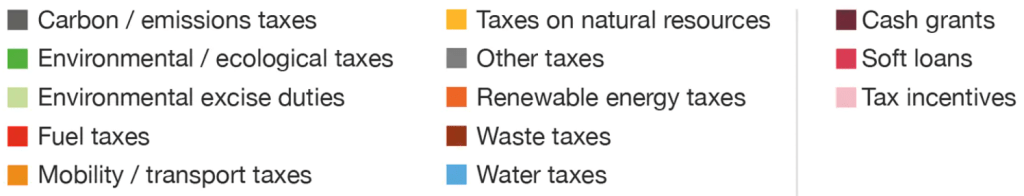

Countries with Energy Efficiency Tax Incentives

Although many developing nations and first-world countries offer tax incentives for various investment reasons, there are few countries offering energy efficiency tax incentives. Here are several countries in the world that have implemented energy efficiency tax incentives. They serve as an example to other nations.

The Netherlands

Tax incentives have promoted energy efficiency in the Netherlands. The Dutch government encourages companies to transition to solar panels, heat infrastructure, energy-efficient technologies, and smart office buildings.

Italy

The Italian government approved an energy tax incentive, which assists companies with energy and fuel price increases caused by the Ukraine crisis. For example, some companies use smart meters to qualify for the tax benefit.

Germany

Companies in Germany receive tax benefits when they invest in decarbonisation and energy efficiency technologies. In this regard, companies with efforts to green their business models benefit greatly from the policy.

South Africa

With the current energy crisis taking place in the country and companies shutting down due to power cuts, the adoption of energy efficiency tax incentives would be beneficial to boost the country’s economy.

Source: PwC Analysis

moving forward

Being energy efficient is one of the issues or goals the THRIVE framework’s FFF and United Nations (UN) Sustainable Development Goals (SDGs) wish to address and achieve. They will move the world toward a sustainable thrivable future for the many generations to come.

Why is it essential To focus on tax incentives that Influence Sustainable Company Habits?

Tax incentives for energy efficiency can be a great way to achieve sustainability and decarbonise our industries, corporate offices, and infrastructure. Nations that have not yet implemented these policies can learn from countries such as the Netherlands, Italy, and South Africa to transition their energy sector to more renewable energy sources. This implementation will assist companies in adopting green and sustainable business models, creating more green jobs in various economies worldwide, and attracting new funding and investment opportunities.

achieving the United Nations Sustainable Development Goals (SDGs) and how they link to Influencing Sustainable Company Habits

The United Nations (UN) has listed 17 Sustainable Development Goals to be achieved. Some will be linked to influencing sustainable company habits so that they can contribute to a sustainable future. Influencing sustainable company habits is not an easy task. However, the involvement of governments providing incentives to encourage company habits is a good strategy to be sustainable. The movement to more energy-efficient sources and technologies addresses the following SDGs and assists in influencing sustainable company habits:

- Access to affordable, clean, and sustainable energy for all – Goal 7.

The movement to more sustainable energy sources such as solar, wind, or biomass improves accessibility to inexpensive and clean energy.

- Contribute to more sustainable economic growth and decent work for all – Goal 8.

Although a shift to energy-efficient technologies reduces traditional jobs in the sector, the move will boost the economy with greener jobs.

- Promote innovation and build sustainable industries and infrastructure – Goal 9.

The use of sustainable materials and recycled materials in corporate buildings, factories, retail stores, etc., advances infrastructure. Companies will seek to develop innovative energy-efficient solutions to reduce greenhouse gas emissions generated by the energy sector.

- Sustainable consumption and production patterns – Goal 12.

The use of recycled waste heat, LED lights, energy storage devices, and clear acrylic doors promotes the consumption of sustainable production materials.

- Take a stand to combat climate change – Goal 13.

The use of energy-efficient sources contributes positively to the overall carbon footprint. The CO2 emissions from burning fossil fuels and coal will decrease drastically. The use of renewable energy technologies is one way to take action to fight the severe effects of climate change, such as global warming and temperature rises.

A Thrivable Framework

The THRIVE project tackles many global problems related to sustainability and climate change. The THRIVE project conducts research on renewal energy sources such as the use of solar panels and wind turbines as alternative ways to generate electricity, reduce air pollution, and also lead communities, societies, and businesses to a thrivable future.

To explore more about how the THRIVE Project conducts research, educates, and advocates for a future beyond sustainability, visit our website. You can follow our informative blog, podcast series, and regular live webinars featuring expert guests in the field. Sign up for our newsletter for updates on upcoming events.