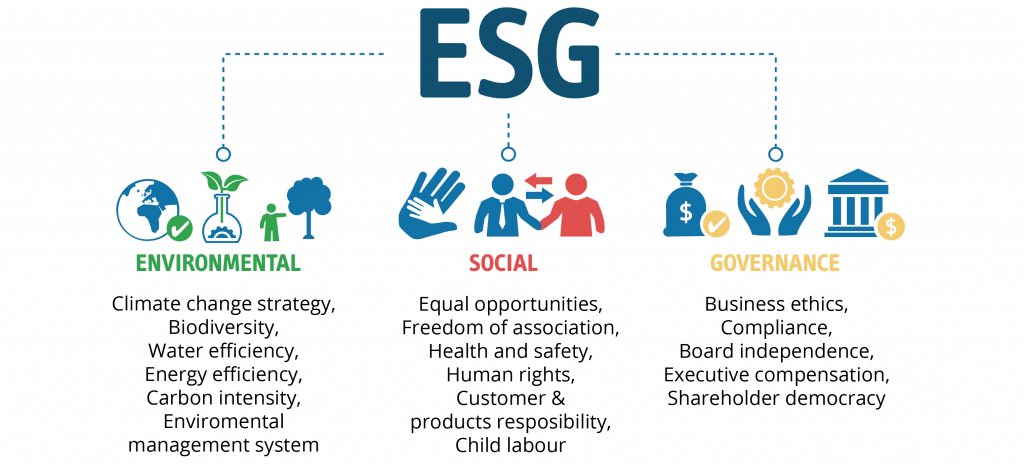

If Socially Responsible Investing (SRI) lived up to its word, the investment market could explode beyond its current representation. Around 10% of all managed assets in the USA and Europe fall in this category. ESG is referred to as environmental, social, and governance (ESG) investing, and reflects a wide range of underlying concerns for investors. Certain ethical beliefs inform judgment about investment decisions. The rise of ESG dates back 3,500 years (in the form of prohibition on domestic business activity within Jewish communities), ESG has a rich and varied history. Interestingly, churches throughout the middle ages took those prohibitions further. They covered weapons, slavery, tobacco, alcohol, and gambling, amongst others.

Source: Anevis

The rise of ESG: An evolution

Initially, the term ‘ethical’ was a broad description of Socially Responsible Investing (SRI). A review of the broad relevance of the term ‘social’ caused it to be replaced with ‘sustainable’. It was later removed completely to arrive at the term ‘responsible investing (RI)’. Environmental, social, and governance (ESG) investing, on the other hand, is an investment strategy. Conversely, it incorporates non-financial criteria, as well as the investments’ financial returns. These non-financial criteria include the impact of companies on the environment and on pressing social issues.

- Operational impact on the natural environment, including carbon emissions, energy, and water use.

- Societal impact, including fair trade principles, health and safety, product safety, and philanthropy

- Corporate governance quality, including corruption and bribery, board independence, and stakeholder protection.

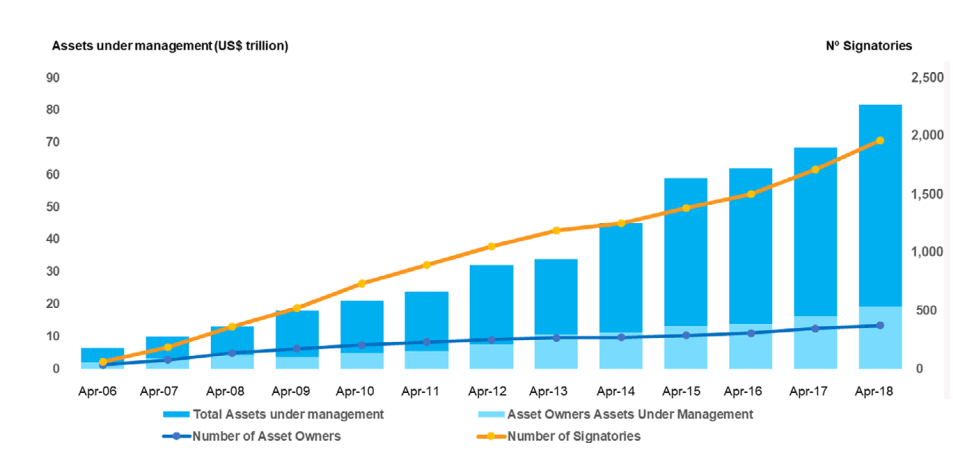

The core belief of ESG investing asserts that investors, society, and the environment can benefit from decisions based on them. Additionally, this is reflected in the number of organisations that signed the Principles for Responsible Investment (PRI). The number increased from 63 in 2006 to 1,714 in 2017. The assets owned or under management grew from $US6.5 trillion to $US68.4 trillion over this same period.

Source: PRI

A Short History of Socially Responsible Investing

The UN’s Principles of Responsible Investment (PRI), preceded ESG. The PRI came into being in 2006 and was accepted by the Chartered Financial Analyst (CFA) Institute in 2008. The ESG investing industry is large, influential, and made up of activities that academics believe can improve with research. Unfortunately, in most cases, research focused more on measuring the performance of returns. The heterogeneous nature of ESG investing; including its costs, motivations, and management literature, leaves five emerging themes.

- The human element

- Climate change

- Fund flows

- Fixed income

- The rise of non-western players.

a Compass for Socially Responsible Investing

Global events with far-reaching effects have affected investment choices in recent times. The Vietnam War, South African apartheid, and American racial discrimination are typical examples. Emphatically, it should be noted that the growth of consumer activism and the civil rights movements of the 60s made ESG investing globally visible and attractive.

SRI is moving with the tide and integrating the rise of ESG into investment analysis. SRI has gained increasing attention for the value of SRI portfolios invested. Additionally, the role of investors in achieving sustainable development goals (SDGs) is becoming increasingly vital. However, investors have raised concerns regarding the lack of a clear definition of what can be classified as socially responsible. The absence of standards for SRI investments, and the quality of available data in ESG are equally of concern.

Source: Zeenea

Socially Responsible Investment & Corporate Governance

According to Sultana et. al., the interest of the financial sector in sustainable development is accelerating at a rapid rate. Undeniably, sustainability is an integration of three foundational facets: environmental, social, and economic. ESG integration in investment decisions, as we have seen recently, is showing increasing growth around the world. However, the global financial crisis (GFC) has promoted the significance of good governance practices. ESG malpractices and their effect on the environment, society, and financial market were evident during incidents such as the Exxon Valdez oil spill of 1989, Nike’s sweatshop criticism of 2005, Coca-Cola’s labour and environmental malpractice of 2006, and the BP oil spill of 2010, among others.

Responsible or Smart Investing and the Rise of ESG

All things considered, the reckless behaviour of companies may incur large clean-up costs in the case of major accidents, sustainability costs, resource consumption costs, loss of consumer trust, potential negative impacts on employee health and morale, responsibilities towards local government, and investing stakeholders. ESG investors are broadly classified into three groups.

- The focus of the first group is on financial performance and the belief that ESG factors affect investment risks and returns.

- The second group seeks to combine certain non-financial objectives (e.g. ethical, religious, political, cultural, and societal values and preferences) without affecting its financial objectives.

- The third group is willing to sacrifice some (or all) financial return to gain other social or environmental benefits (and their community impact on investing in charities).

Conversely, asset owners and investment managers who have formed or joined voluntary associations and networks in the field of ESG make use of these three groups. These cover corporate governance, climate change, and related issues. Many investors have complied with voluntary codes. Many of them are at the national level. However, these are still voluntary and are not subject to the rigour of international standards.

ESG and Research

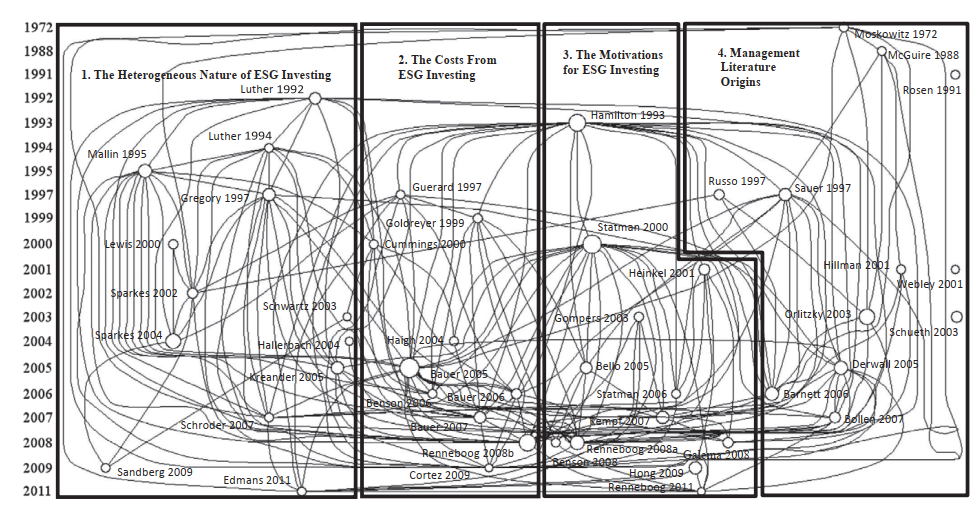

Daugaard, 2019 examined the relationships between the top 47 cited references from 463 articles and books in the ESG investing literature. Evidently, the node map shows these interconnections between the top 47 items. We selected this number of citations because it contained a reasonably high quantity of the top citations without cluttering the graph with densely overlapping links.

Source: Wiley Online Library

The citation map shows that there is a high degree of cross-citation occurring in the ESG investing literature. Clustered items are determined by the pattern of citation between the articles. This may mean that cross-citation relies on a fixed and standard version within ESG. That particular article goes on to explain that there are calls for codes of practice and standardisation of terminology and activities for ESG investing. However, as explained, ESG investing is likely to remain heterogeneous because cultural and ideological differences are important to investors. Investment firms will likely increase their range of terms and practices to make their fund offerings stand out from competitors.

A Closer Look

Accordingly, if heterogeneity is to remain in an academic sense, more relevant theories and techniques are crucial.

“What is required is an empirical example where models based on mixed motives (rather than narrowly defined economic self-interest) may be appropriate and informative.”

Daugaard, 2019

Future research needs to contribute more sophisticated theories to accommodate the heterogeneous nature of ESG investing. In addition, ESG reporting seeks investors with simpler ways of assessing sustainable development issues, through calls for a reduction in the number of sustainability reporting frameworks and standards. This has allowed a brand-new industry to emerge, providing ESG data, ratings, and rankings for the benefit of investors. These agencies are demanding more consistent and comparable ESG disclosure from companies leading to actively seeking to ‘harmonise’ the proliferation of frameworks, standards and national regulations.

Moving Forward

We sought to examine the main drivers for Socially Responsible Investing (SRI) and have sought to provide history of this trend. These drivers are undoubtedly at the heart of ethical behaviour in business, a major driving force for investing in the future. Generally, the main challenge for ESG is simply to bring future research into line with reality in the world, creating a concept that captures the different forms of the diverse ESG investor community. In addition, to introduce the concept, new implementation techniques are also necessary. They present a methodology for incorporating heterogeneous ESG concerns of individuals and institutions with the traditional portfolio objectives of wealth maximisation. Certainly, more academic work in the area would be a good first step and it could leverage this approach by incorporating big data and automated investment platforms.

why Is it essential that we focus on The Rise of ESG?

It is vital to address the importance and role of ESG investments and the importance of any shortcomings. In order to have an effective impact on ESG investing, there must be much more standardised, international regulation, as informed by research and academic approaches. In order to keep up with global realities, a standardised research-informed approach to contribute more sophisticated theories as guidelines is needed.

achieving the United Nations Sustainability Development Goals (SDGs) and how they link to The Rise of ESG

ESG investment has strong links to the United Nations SDGs. These include all of the 17 SDGs, from SDG13 (Climate Change) to SDG4 (Quality Education). Effective ESG investment will benefit all SDGs and address environmental, social and governance issues.

Source: United Nations

A Thrivable Framework

THRIVE invests interest in issues fundamental to the integrity of our society. As part of measuring sustainability, this also includes looking at approaches taken by investors, to address environmental, social and governance issues which are all central to THRIVE’s mission.

‘Thrivability‘ goes beyond mere sustainability, ensuring that environmental, social and governance issues are addressed, enabling a thrivable future to unfold. THRIVE’s belief is that humanity can do better with the knowledge currently available to us. By being aware of any shortcomings and hopes of ESG investing, we are able to act upon this information effectively in order to combat threats to its purported purpose. THRIVE’s mission is not just to offset disaster, but to allow for a society in which all are able to flourish.

Finally, THRIVE Framework examines issues and evaluates potential solutions – making

predictive analyses using topics such as this, that support environmental and

social sustainability transformations. Furthermore, we recognise that human happiness can sometimes compete with environmental well-being, which is why we use our ciambella chart to illustrate the ‘thrivable zone’.

At THRIVE, we intimately promote the meeting of environmental, ecological and social needs, simultaneously, without adversely encroaching on each other. We research, educate, and advocate to effectively address environmental, social and governance issues. THRIVE has the capacity to ensure that these issues are easily safeguarded, creating a more thrivable world and a future beyond sustainability.

Visit Thrivability Matters for an informative, diverse blog and podcast series addressing human rights and social issues alongside environmental issues. THRIVE holds regular live webinars featuring expert guests in diverse fields. The THRIVE Project offers knowledge to help with new implementation techniques and information regarding ESG Investing. Sign up for our newsletter here.